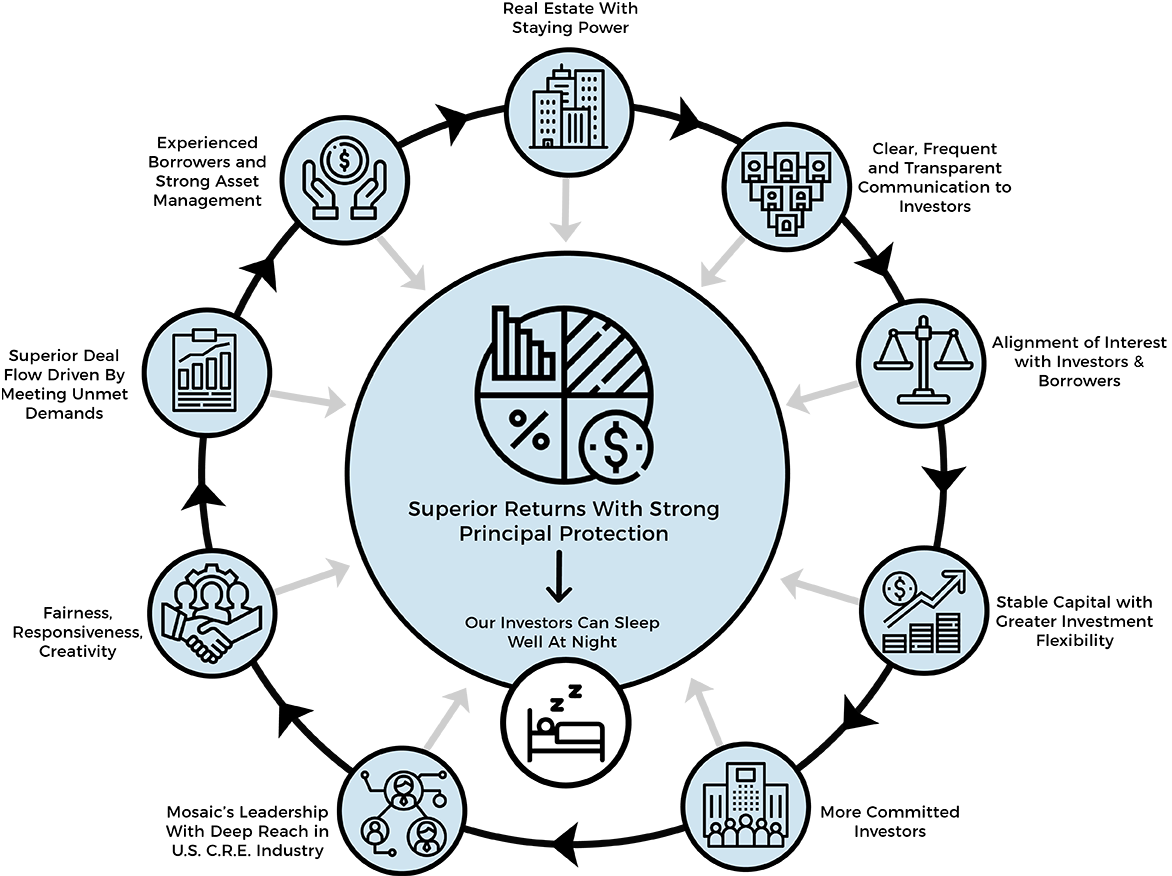

WHY OUR INVESTORS ARE OUR PARTNERS

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

HEADING

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |

Real Estate & Borrower Business Plan

- Total collateral consists of a 301.71-acre site located in Coachella Valley’s town of La Quinta, CA

- Project plans include a 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center

- Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand

- Three development parcels (planning areas 6, 7, and 8) totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

MREC Investment Attributes

- Site is within the highest net worth area in Coachella Valley, and a leading golf destination in the United States

- Upon completion (projected January 2021), hotels and residences will be newest product in the market

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

- Developer to contribute substantial equity, totaling $88.22M

- Numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

Borrower & Development Team

- The Robert Green Company boasts a strong development track record of success within the luxury hospitality industry; prior completed projects include Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- Subject site benefits from an experienced management team and the well-known Montage and Pendry hotel brands

DEAL TERMS

Priority – 1st Trust Deed

Use of Proceeds – To finance the construction of the SilverRock Resort & Residences

MREC Investment – $212,500,000 ($531,250 / Key)

Total Investment Amount – $300,720,000 ($751,800 / Key)

Projected Value* – $409,500,000 ($1,023,750 / Key)

Loan to Value – *51.89%

Investment Period – 3 years (two 1-year extensions)

Interest rate – 30-Day LIBOR + 1100 bps

Unused Fee – 0.50% on Initial $36M; 0.50% on the $176.5M upon commencement of Vertical Construction

Commitment Fee – 2.00% of Loan Amount

Exit Fee – 1.00% of Repaid Amount

Extension Fee – 1.00% of Loan Amount Extended

SOURCES & USES

USES

| Construction | $155,478,321 |

| FF&E and OS&E | $32,696,891 |

| Design Fees | $19,172,049 |

| Professional & Technical | $4,355,722 |

| R.E. Taxes & Insurance | $4,335,882 |

| Supervision (G&A) | $7,378,288 |

| Permits & Fees | $7,798,729 |

| Pre-Opening Expenses | $4,300,000 |

| Working Capital | $900,000 |

| Development Fee | $7,694,107 |

| Financing Costs | $7,207,315 |

| Residential Sales & Marketing | $1,240,826 |

| Residential HOA | $700,000 |

| Construction Period Interest | $16,753,030 |

| Contingency | $13,322,174 |

| Estimated Reserve for Vertical Construction | $17,386,667 |

| TOTAL USES | $300,720,000 |

SOURCES

| Equity | |

| Initial Borrower Equity | $12,000,000 |

| Additional Borrower Equity | 76,220,000 |

| Debt | |

| Pre-Development (Initial Funding) | $14,306,883 |

| Pre-Development (Future Funding) | $21,693,117 |

| Vertical Construction | $176,500,000 |

| TOTAL SOURCES | $300,720,000 |