TRANSACTION SUMMARIES

Summary

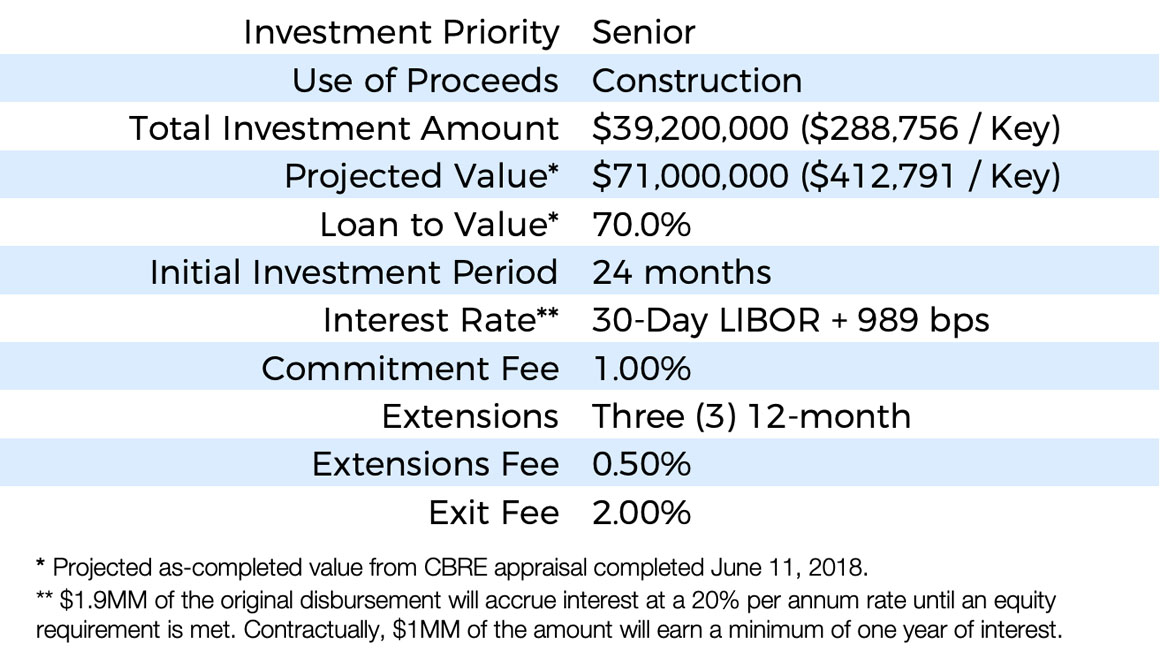

Construction of a 240–room full service hotel located in Southlake, Texas. Situated on a 6.28-acre site, Delta Southlake will be comprised of one six-story building totaling 165,745 SF with 4,510 SF restaurant space and 10,810 SF meeting space. Upon completion, the hotel will be franchised as Delta by Marriot and operated by Interstate Hotels & Resorts.

Investment Attributes

- Property will be franchised as Delta by Marriott, Marriott International’s newest upscale, full-service hotel brand

- Once complete, will be operated by Interstate Hotels & Resorts, a recognized leader with a 500-property global portfolio under management

- Borrower has invested almost $2.4MM in pre-development costs for the project to date and has secured $37.5MM permanent loan from BancorpSouth

- Southlake is an affluent suburban city with highest per capital income in the country for cities with a population over 20,000 residents, locating 25 miles northeast of downtown Fort Worth, 25 miles northwest of Downtown Dallas

Borrower & Development Team Experience

- Sponsor has a proven track record of acquisition, development, rehabilitation and operation of properties for over 30 years.

- Sponsorship is further enhanced by additional expertise with Hill & Wilkinson as General Contractor. Founded in 1968, Hill & Wilkinson has been in operation for 50 years.

Real Estate & Business Plan

Property Type: Hotel

Area: Dallas

Keys: 240

Total SF: 165,745

Stories: 6

Meeting Space (SF): 10,810

Restaurant Space (SF): 4,510

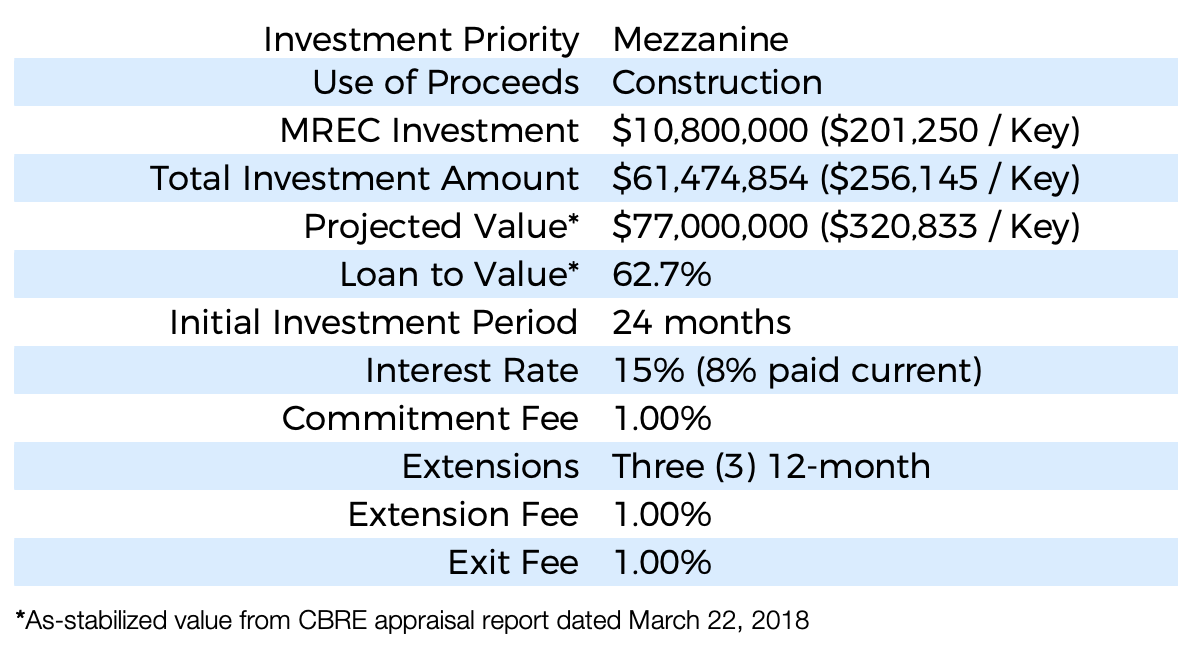

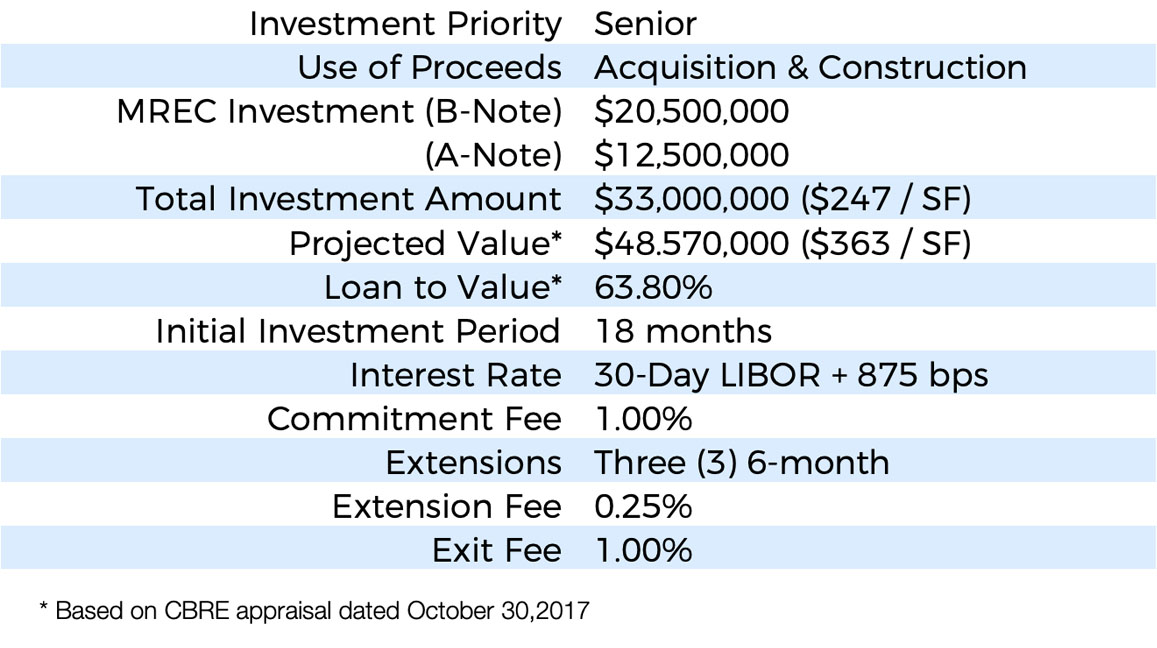

Deal Terms

Summary

The subject property is a 1.73 acre parcel of land with 411 feet of frontage on the Hillsborough Rover in Downtown Tampa fully entitled for the development of a 58-story, luxury condominium tower.

Investment Attributes

- The Project location on the Hillsborough River is the only waterfront site in the Tampa CBD and one few large waterfront development sites available in the Downtown Tampa area.

- The property’s planned condominium units (construction not a part of this Loan) will benefit from unobstructed views of the river and Tampa Bay which will be unmatched by anything recently completed or planned in the submarket.

- Downtown Tampa is currently under significant development, exemplified by the planned $3 billion, 50-acre development of Water Street Tampa.

Borrower & Development Team Experience

- Sponsor has been involved in other similar projects in Florida

- This is the Sponsor’s second project with Mosaic, the first being Elysee in Miami. Sponsor paid original 12-month maturity loan at Elysee 2 months early in August 2018.

Real Estate & Business Plan

Property Type: Condo

Area: Tampa, Florida

Stories: 58

Units: 287

Waterfront Retail (SF): 35K

Riverside Frontage: 411 ft

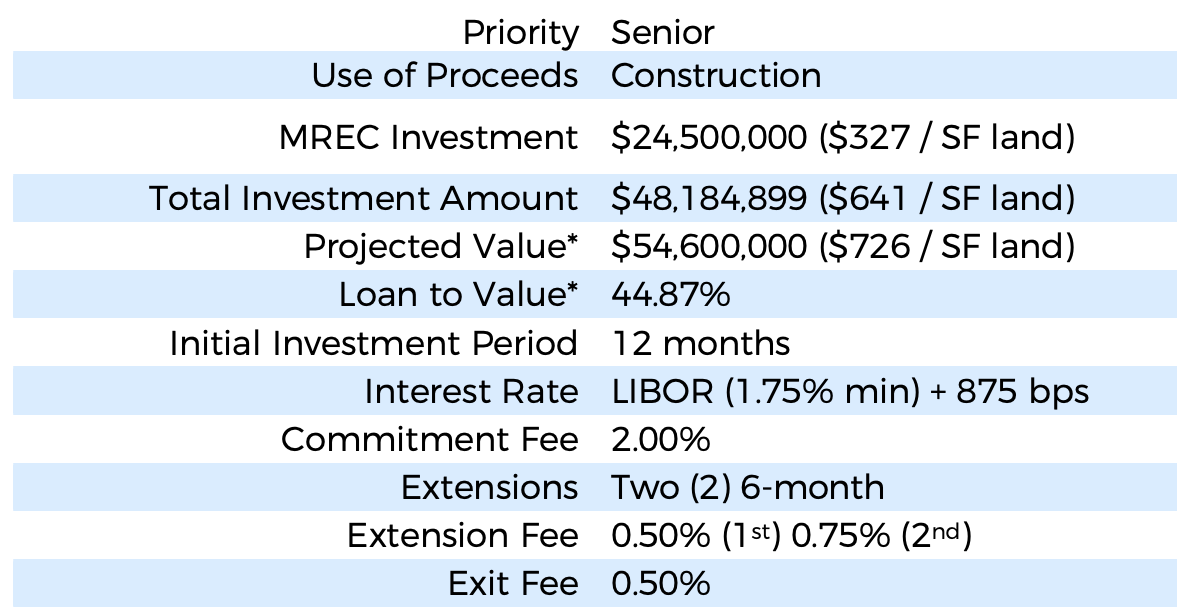

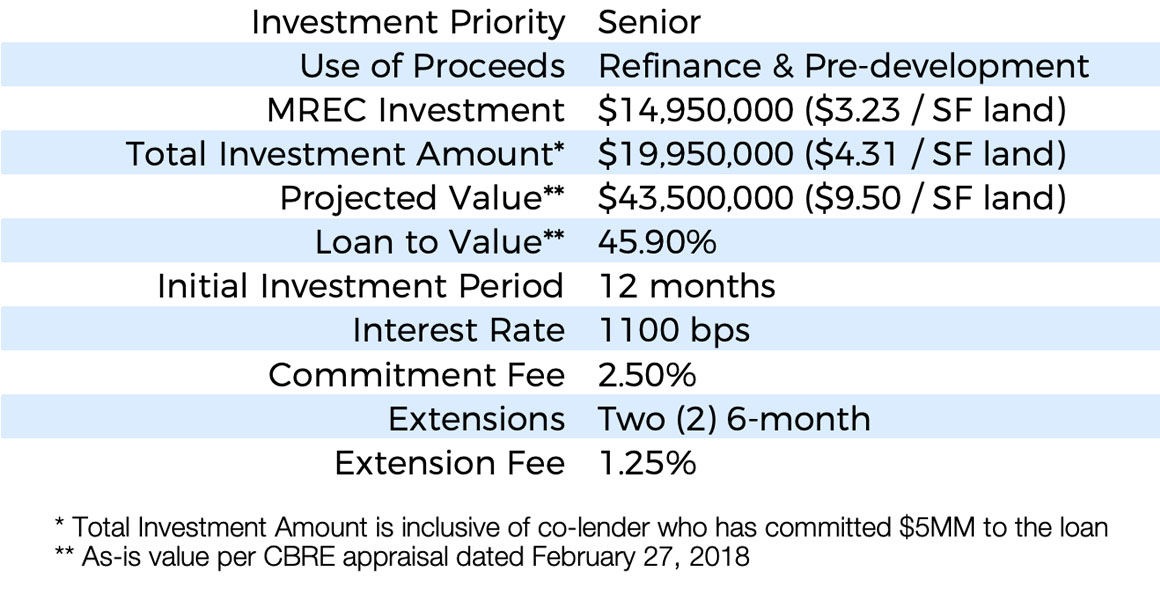

Deal Terms

Summary

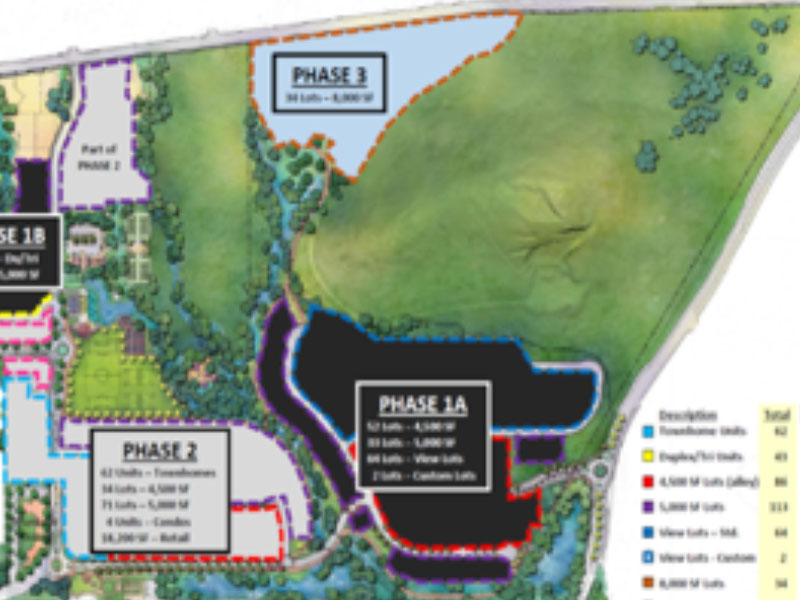

Finances acquisition of land consisting of four distinct parcels: Aetna Springs (Resort, 16 Residential Estates, and Vineyard – 623 acres), Lake Luciana North (195 acres), Lake Luciana South (Vineyards planted and plantable land – 432 acres), and Turkey Hill (9 Residential Estates and plantable land – 612 acres). Sponsor intends to acquire Luciana North, South and Turkey Hill for immediate sale for vineyard and residential development, using proceeds to repay MREC’s investment prior to prepping the Resort for predevelopment.

Investment Attributes

- Aetna Springs, an unincorporated community which lies in northern Napa County, is considered by the winery community to fall within the coveted “Napa Valley” region

- MREC repayment hurdles incentivizes swift development progress and repayment, with its ongoing interest reduced at increasing tiers as balance is paid down

- Last Resort zoned entitlements permitted in Napa County

- Surrounding Vineyards posses highly valuable water rights

Borrower & Development Team Experience

- Sponsor has 40 years of experience in real estate and investment banking.

Real Estate & Business Plan

Property Type: Multi-Use Land

Area: Pope Valley, California

Total Acres: 1,862

Residential Estate Plots: 25

Capital Event Waterfall Hurdles: 7

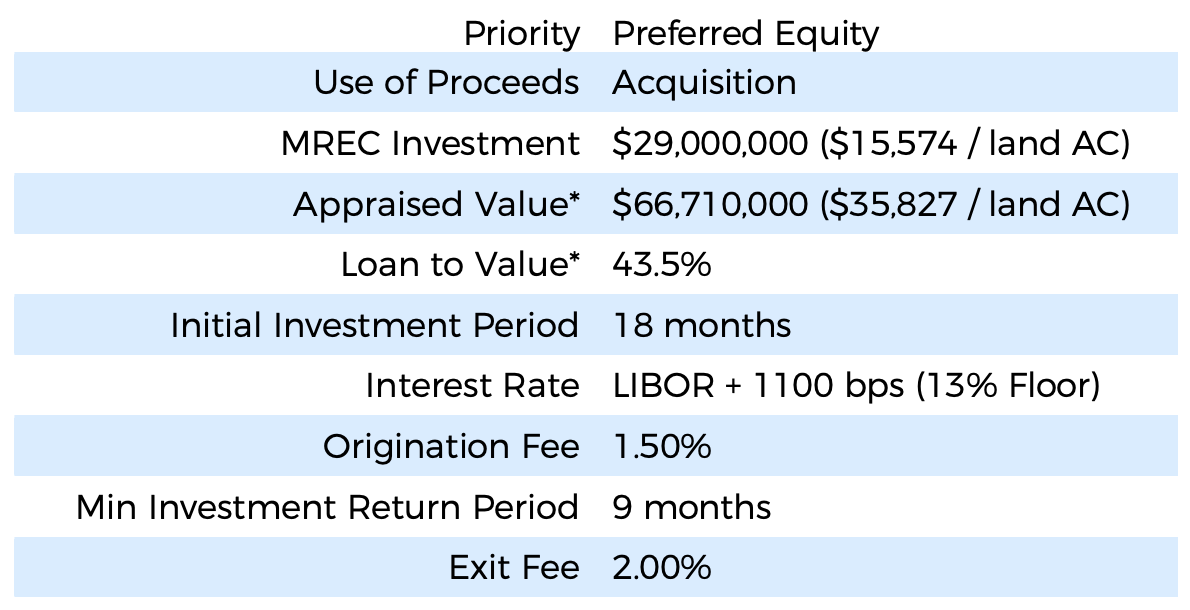

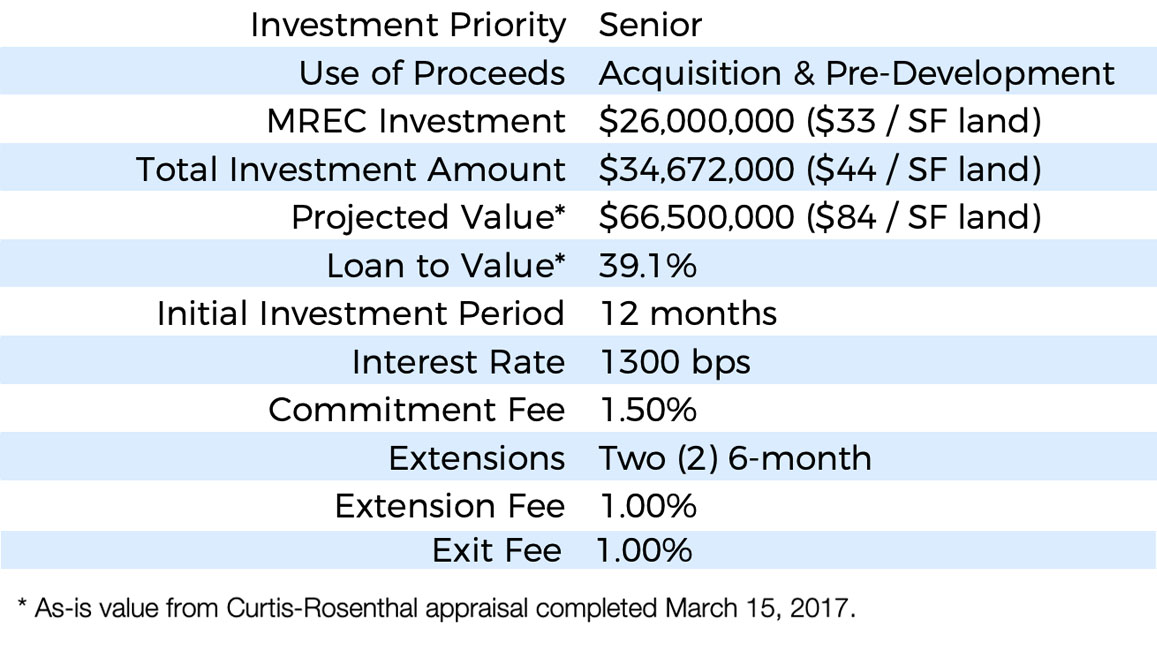

Deal Terms

Summary

Acquisition of a built and operational 898-unit (915K SF), three property multifamily portfolio spread across Arkansas and Georgia, consisting of apartment complexes in Columbus (386 units), and two in Little Rock (296 and 216 units). Sponsor plans to complete a $2.5M portfolio-wide renovation to upgrade and reposition properties to maintain occupancy, grow rents, and monetize the increased value through a sale or refinance at stabilization.

Investment Attributes

- Portfolio totals 59 acres over 3 properties

- Properties are located in strong rental markets and have actual occupancy rates averaging 94.8%

- Mosaic has an investment basis of $75 PSF, or $70,286 per unit (when including senior debt) compared to as-stabilized in year 5 value of $108 PSF, or $100,883 per unit; the current cap rates on the properties range from 6.2% to 7.3%

Borrower & Development Team Experience

- Sponsor has over 30 years of experience in development of hotels across the U.S.

- On-site property management to be run by highly experienced firm managing similar properties, which will focus on upgrading existing processes to increase efficiency

Real Estate & Business Plan

Property Type: Multi-Family

Area: Columbus, GA | Little Rock, AR

Strategy: Value Add

Portfolio Units: 898

Portfolio SF: 915K

Properties: 3

Renovation: $2.5M

Occupied: 94.8%

Prudential Senior Loan: Fannie Mae

Deal Terms

Summary

Construction of a 301.7-acre site in the Coachella Valley into a flagship 140-room Montage luxury full-service hotel, a 260-room Pendry full-service lifestyle hotel (initially 200 until completion of the Pendry residential units), an 18-hole Arnold Palmer golf course, and conference center. Each hotel will offer branded residences; 29 units with Montage brand, and 66 with Pendry brand. Upon completion (projected January 2021), hotels and residences will be newest product in the market.

Investment Attributes

- Developer to contribute substantial equity, totaling $88.22M

- Robust tourism with numerous demand generators in the proximate area include the Coachella Valley Music and Arts Festival, the La Quinta Arts Festival, the Palm Springs Convention Center, PGA Tour events, and various sports tournaments

- Site is within high net worth area in Coachella Valley, and one of the leading golf destinations in the United States

- Three development parcels totaling approximately 51.0 acres are entitled for 390 single family residences; these areas are expected to be sold within twelve months from closing

Borrower & Development Team Experience

- Sponsor has a strong track record of success in project including Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Pendry San Diego

- MREC will require the project to be constructed under a bonded guaranteed maximum price (GMP) contract

Real Estate & Business Plan

Property Type: Hotel

Area: Cochella

Montage Keys: 140

Pendry Keys: 260

Montage Residences: 29

Pendry Residences: 66

Arnold Palmer Golf Course: 1

Conference Center: 1

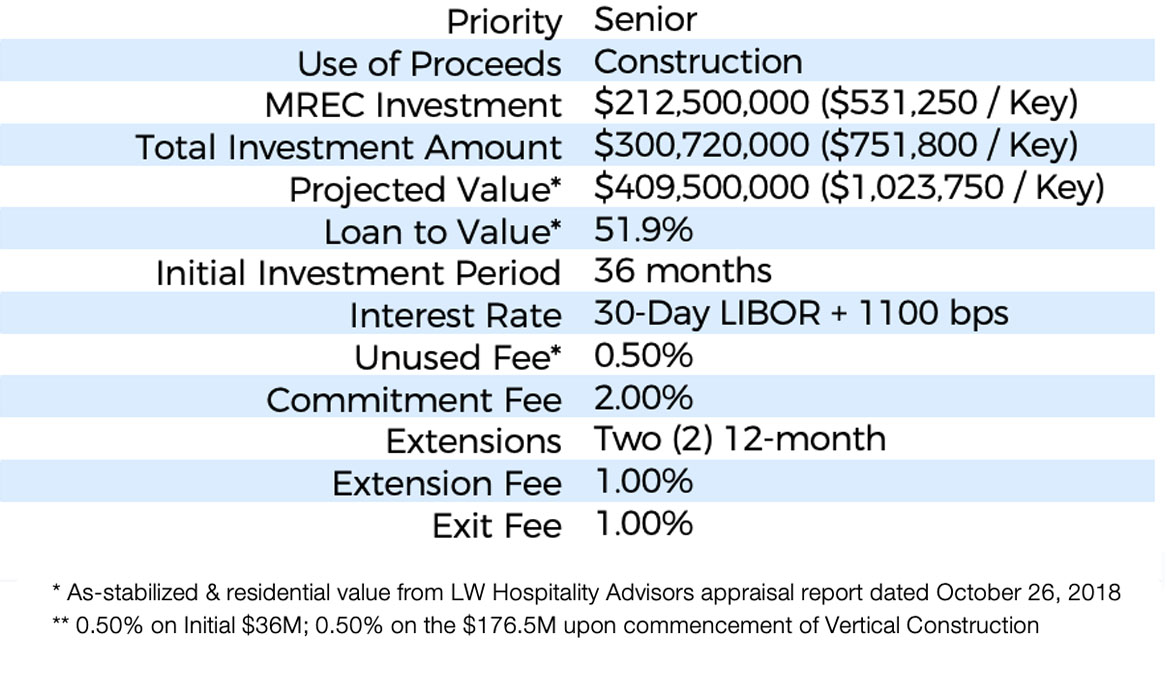

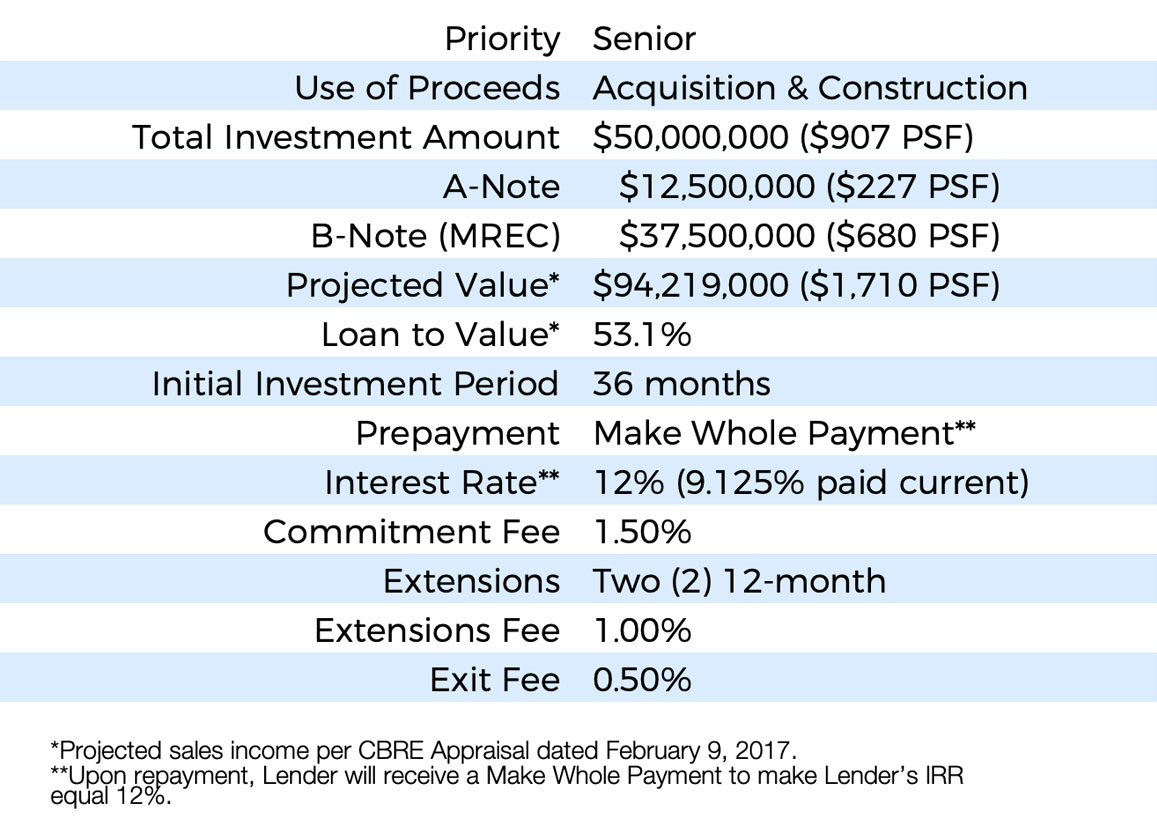

Deal Terms

Summary

Renovation of well-located vacant office building in Downtown Los Angeles to 180-key Cambria Hotel and Suites. Project will also include a mezzanine level restaurant & lounge, fitness center, business center, sundry shop, ~4,600 SF of restaurant space and ~2,500 SF of dedicated meeting space. Located in DTLA historic core in highly amenitized area currently undergoing revitalization.

Investment Attributes

- Project will benefit from the Cambria Hotels flag and extensive reservation system of Choice Hotels International, representing 500K+ rooms

- Choice Hotels International invested key money

- The Packard Companies will provide additional management expertise. Packard is a full-service turn-key hotel operator and property management company, with 800+ employees encompassing 3 divisions, 25 hotels, 21 associations, and 15 commercial projects

- Borrower has invested almost $19.6M in pre-development and acquisition costs for the project to date

Borrower & Development Team Experience

- Sponsor has a proven track record of ownership and/or a management role in nearly 30 hotels nationwide

- Sponsorship is further enhanced by additional expertise with The Packard Companies, Stegeman & Kastner, Inc. and Angeles Contractor, Inc.

Real Estate & Business Plan

Property Type: Hotel

Area: DTLA

Keys: 180

Total SF: 143.5K

Stories: 13

Meeting Space (SF): 2,512

Restaurant Space (SF): 4,595

Deal Terms

Summary

Five-building, low rise creative office complex in DTLA which sits on a 4.59-acre site in-between the CA-110 freeway and Figueroa Street. Fully renovated in 2016, the Sponsor employed a value-add business plan to lease vacant space and roll existing tenants to market rate upon renewal.

Investment Attributes

- Renovations include a significant re-energization of the façade, seeking to capitalize on signage via strong visibility in CBD and CA-110 Freeway on-ramp

- The exterior is set to undergo further enhancements across the property’s outdoor shared meeting space, a major perk due to DTLA’s density

- In the past three years DTLA’s CBD has seen over 1,056,000 SF of office space leased to 13 major media, tech, and fashion businesses

Borrower & Development Team Experience

- Sponsor has a proven track record and history of success in the DTLA market, including a five-asset portfolio in the CBD.

- Large Institutional Investor is a part owner of the subject property.

- Sponsor has already invested $14.5M in renovations to date.

Real Estate & Business Plan

Property Type: Office

Area: DTLA

Renovated: 2016 – $14.5M

Buildings: 5

Total SF: 270,449′

Ceiling Height: 16 ft

Strategy: Lease Up

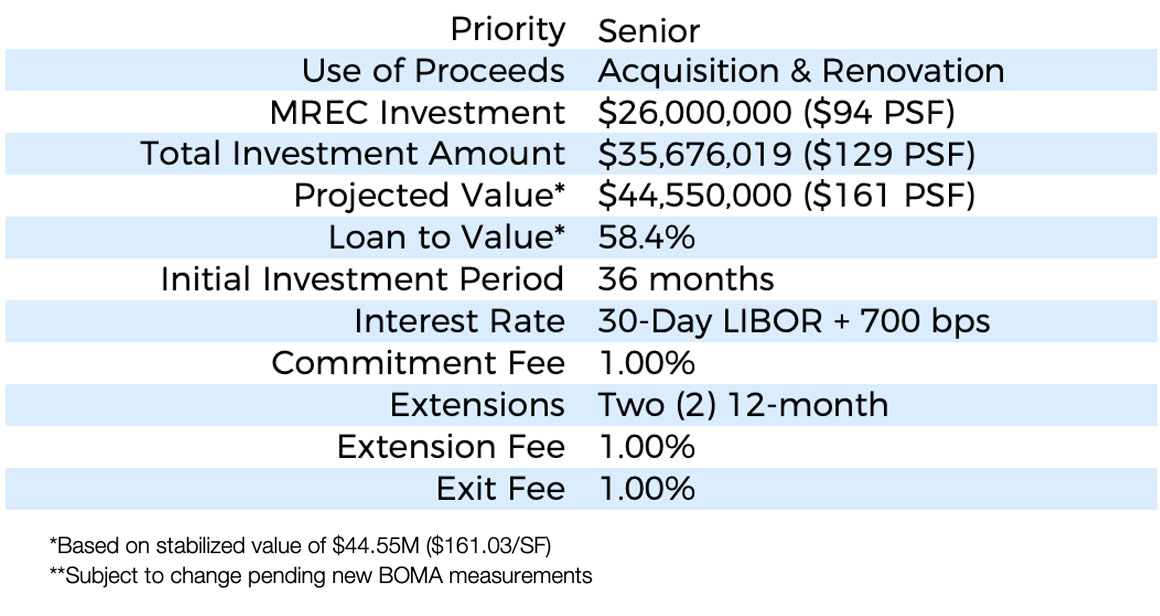

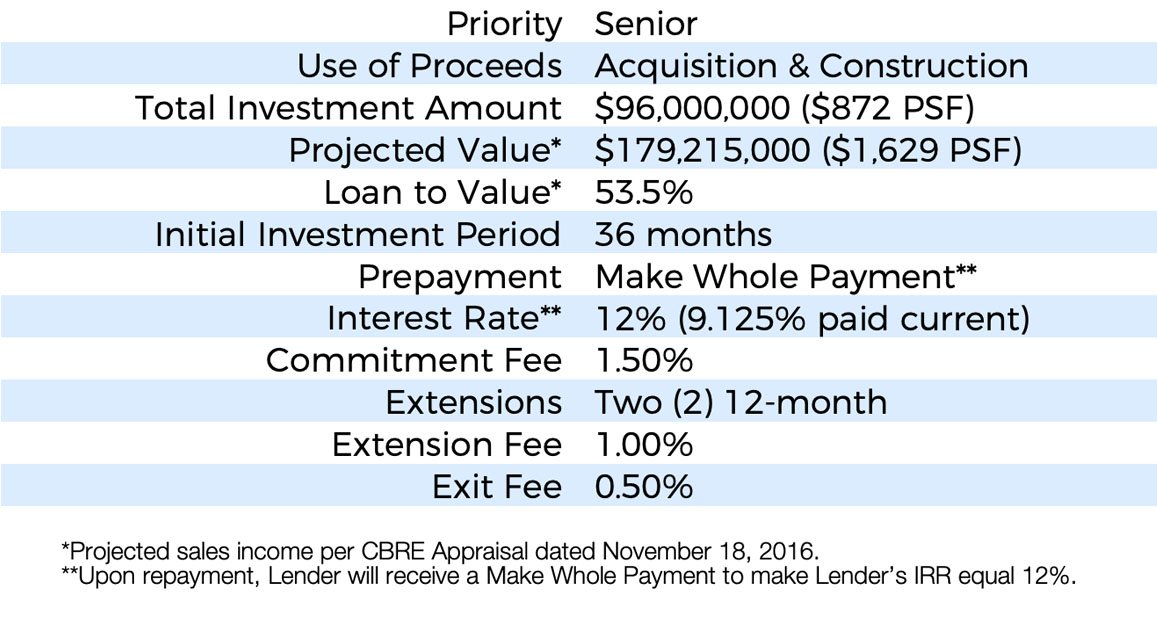

Deal Terms

Summary

Predevelopment of a 0.39-acre site for two mixed-use residential/retail buildings in the Tenderloin neighborhood of central San Francisco. Project is entitled for 231 micro units in two eight-story buildings comprised of two non-contiguous parcels at 361 Turk St and 145 Leavenworth St.

Investment Attributes

- The subject project is located in a very high barrier-to-entry market; between 2007-2014, San Francisco only permitted 18% of the city’s Regional Housing Needs Assessment goals of 1,234 moderate income units

- The Civic Center/Tenderloin submarket has a 2.9% vacancy rate, with only 766 units in the Civic Center/Tenderloin submarket under construction

- Located in highly convenient location, with walkable access to two BART stations, Muni, and Caltrain. San Francisco’s Financial District is a brief 5-minute ride away

Borrower & Development Team Experience

- Sponsor is an acclaimed architect and serial entrepreneur who holds over forty years of experience in architecture and design

Real Estate & Business Plan

Property Type: Land

Area: San Francisco

Parcels: 2

Acres: 0.39

Micro Units: 234

Entitled: 100%

Deal Terms

Summary

Renovation of historic vacant hotel buildings in Downtown Sacramento into 172-key Hyatt Centric, Hyatt’s newest branded full service lifestyle boutique hotel. The construction and adaptive reuse project will be built over the Jade Apartments and the historic Marshall Hotel sites, incorporating the historic facades of the old Marshall Hotel into the design and feel of the hotel. Plans include a high-end restaurant and will contain 2,500 SF of meeting space and approx. 1,000 SF of ground floor retail.

Investment Attributes

- The 0.26 acre site is uniquely located adjacent to new Golden1 Center in Downtown Sacramento, home of the NBA’s Sacramento Kings, cultural events, and concerts

- In addition to the Sponsor’s equity contribution, Hyatt Hotels Corp. will invest $6.5M in preferred equity and Interstate Hotels & Resorts will invest $750k in key money

- Financial support from the City of Sacramento through the Downtown Sacramento Revitalization Corporation (“DSRC”), an entity created to invest on behalf of the city, will provide $4M of subordinated financing junior to the MREC loan

Borrower & Development Team Experience

- Sponsor has over 15 years and $900M of experience and will develop the property

- Sponsor experience includes ground up development and operational management in the Sacramento, Davis, Sonoma/Napa Valley, Dallas, and Kauai markets

Real Estate & Business Plan

Property Type: Hotel

Area: Downtown Sacramento

Keys: 172

Competitive Developments: 0

Stories: 11

High-End Restaurant: 11

Meeting Space (SF): 2,500

Ground Floor Retail (SF): 1,000

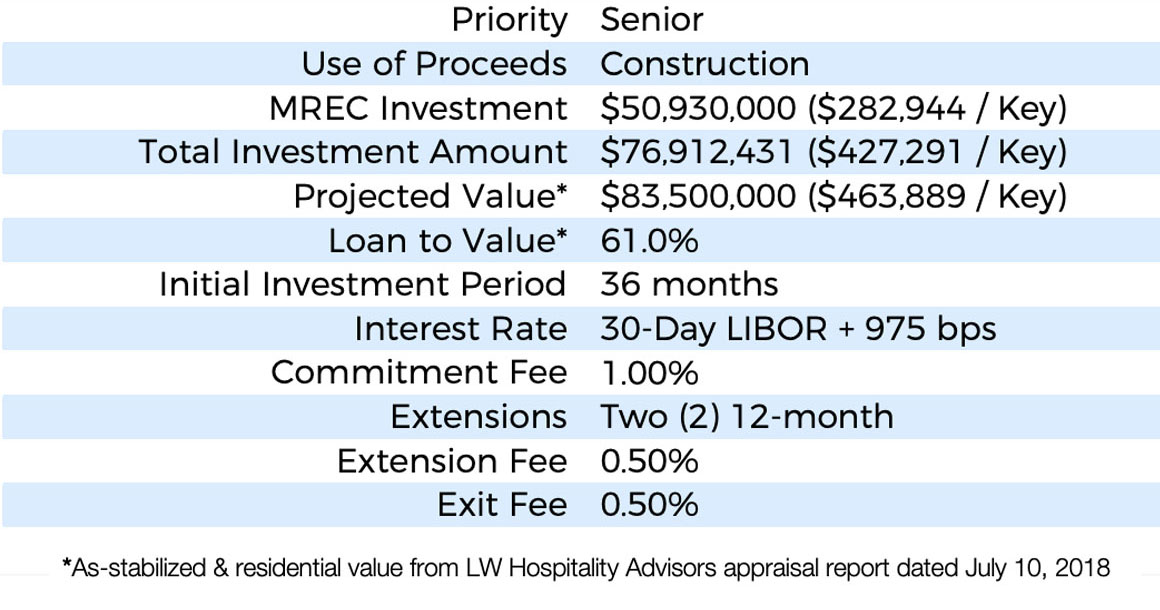

Deal Terms

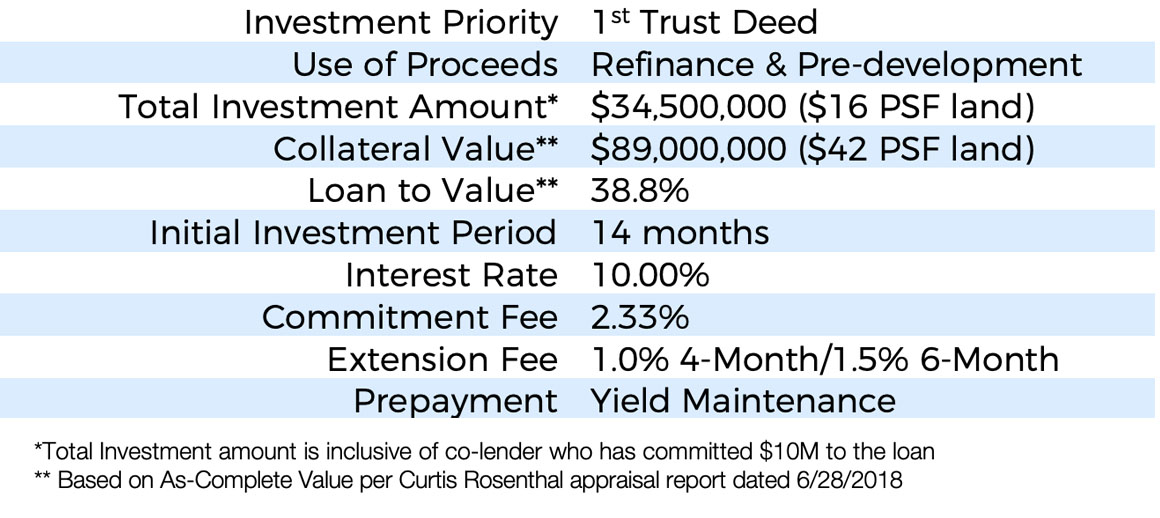

Summary

Predevelopment of 48.9 acres of entitled land in San Luis Obispo zoned for the development of a master-planned community, of which 114 residential lots are presently under contract to be sold to Williams Homes. Which is institutionally backed by IHP and Presidio, Williams Homes closed on the first phase of two neighborhoods (34 4,500 SF lots & 80 5,000 SF lots) in the week of June 25th, 2018 (deposit is non refundable).

Investment Attributes

- San Luis Obispo is a severely undersupplied housing market, with Cal Poly University, County government offices, and hundreds of ancillary business, resulting in an employment population ~3x greater than the number of residents

- Site is within a five- to ten-minute commute to any location within the city, including job centers at Cal Poly State University and Downtown San Luis Obispo.

Borrower & Development Team Experience

- Sponsor has significant development and homebuilding experience, primarily through the Corky McMillin Companies, which has developed nearly 30,000 residences, 16 master planned communities, shopping centers, commercial office and industrial parks, and college dormitories

- The Great American Insurance Company (a $45B insurance conglomerate) is Ambient Communities’ joint venture equity investor

Real Estate & Business Plan

Property Type: Land

Area: San Luis Obispo

Townhome Units: 62

Duplex/Triplex Units: 434,500

SF Residential Lots: 345,000

SF Residential Lots: 808,000

SF Residential Lots: 34

Retail Space (SF): 18,200

Deal Terms

Summary

Acquisition of a built and operational 784-unit (734K SF), four property multifamily portfolio spread across Mississippi and Arkansas consisting of apartment complexes in Bryam (240 units on 20 acres), Richland (208 units on 18 acres), Horn Lake (168 units on 13 acres), and Little Rock (168 units on 8 acres). Sponsor plans to complete a $2.1M portfolio-wide renovation to upgrade and reposition properties to maintain occupancy, grow rents, and monetize the increased value through a sale or refinance at stabilization.

Investment Attributes

- Portfolio totals 59 acres over 4 properties

- Properties are located in strong rental markets and have actual occupancy rates ranging from 90.0% to 94.6%

- Investment basis of $75 PSF, or $70,286 per unit (when including senior debt) compared to as-stabilized in year 5 value of $108 PSF, or $100,883 per unit; the current cap rates on the properties range from 6.2% to 7.3%

Borrower & Development Team Experience

- Sponsor has over 30 years of experience in development of hotels across the U.S.

- On-site property management to be run by highly experienced firm managing similar properties, which will focus on upgrading existing processes to increase efficiency

Real Estate & Business Plan

Property Type: Multi-family

Strategy: Value Add

Portfolio Units: 784

Portfolio SF: 734K

Properties: 4

Renovation: $2.1M

Prudential Senior Loan: Fannie Mae L + 425

Deal Terms

Summary

106.21-acre parcel of land within the Metro Air Park Special Planning Area (SPA) – zoned for mixed-use, retail, industrial, office & hotel uses – located just east of Sacramento International Airport with excellent access to Interstate 5, Interstate 80, and Highway 99.

Investment Attributes

- Subject is located in a high-barrier to entry market due to a de-facto moratorium on new construction that was recently lifted, enabling developers to take advantage of accommodative zoning and pent-up demand for commercial properties to serve the airport

- The site is located in newly developable land situated directly between the recently built $100M (855k SF) Amazon Distribution Center to the North and I-5 to the South.

Borrower & Development Team Experience

- The Sponsor has developed and constructed over 2,000,000 square feet of office, retail and industrial buildings, single family homes and multifamily residential projects

- Since 2012, the Sponsor has completed over $1B in value-add real estate investments

Real Estate & Business Plan

Property Type: Land

Area: Sacramento

Parcels: 6

Acres: 106.21

Deal Terms

Summary

Predevelopment of 5-acre parcel of land entitled for a mixed use community development in the Lloyd District of Portland, Oregon. Plans include carefully-curated retail and interactive public/private outdoor space within one of the nation’s fastest-growing economies.

Investment Attributes

- Directly adjacent to a MAX light rail stop, Lloyd Center, and the Holladay Park (currently undergoing a $120M renovation into a modern lifestyle center)

- Because site has already been approved by the Design Review Commission, the Property will not be hindered by Portland’s new inclusionary zoning legislation

- The Sponsors achieved entitlements after pursuing approval for their plan and spending over $11M since October 2014

Borrower & Development Team Experience

- Palmer Investments, managed by Dan Palmer, who has over thirty years of experience in the industry, develops and maintains real estate throughout the United States

- Dan Palmer also served as Associate Partner for G.H. Palmer Associates for over 30 years, where he was involved in the development of more than 5,000 apartments

Real Estate & Business Plan

Property Type: Land

Area: Portland

Retail SF: 39.7K

Live/Work Units: 12

Parking Stalls: 536

Live/Work Units: 12

Bike Parking Spaces: 1,155

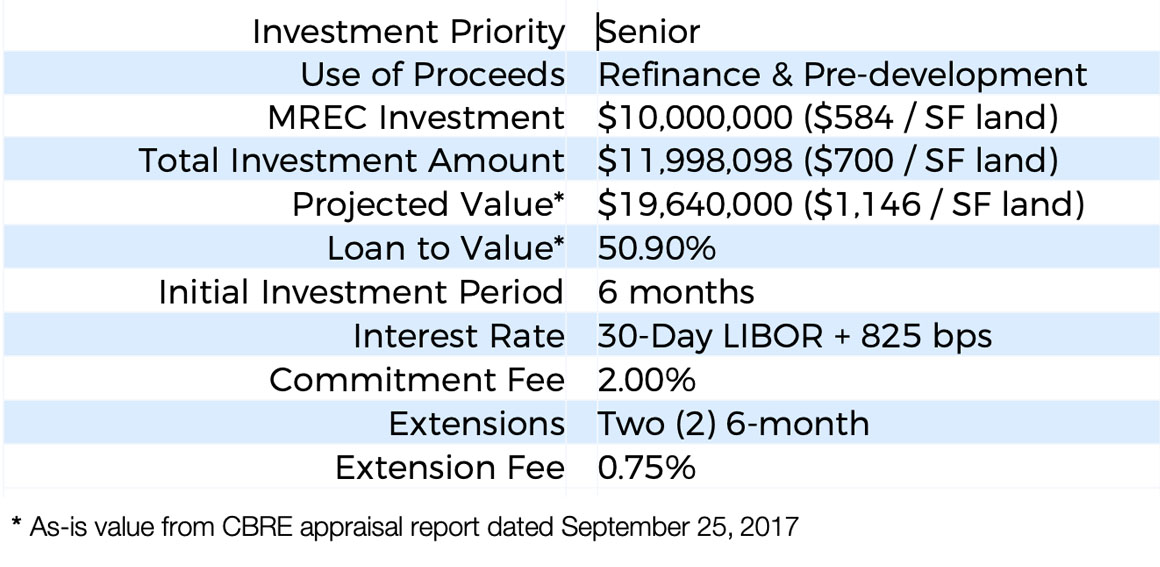

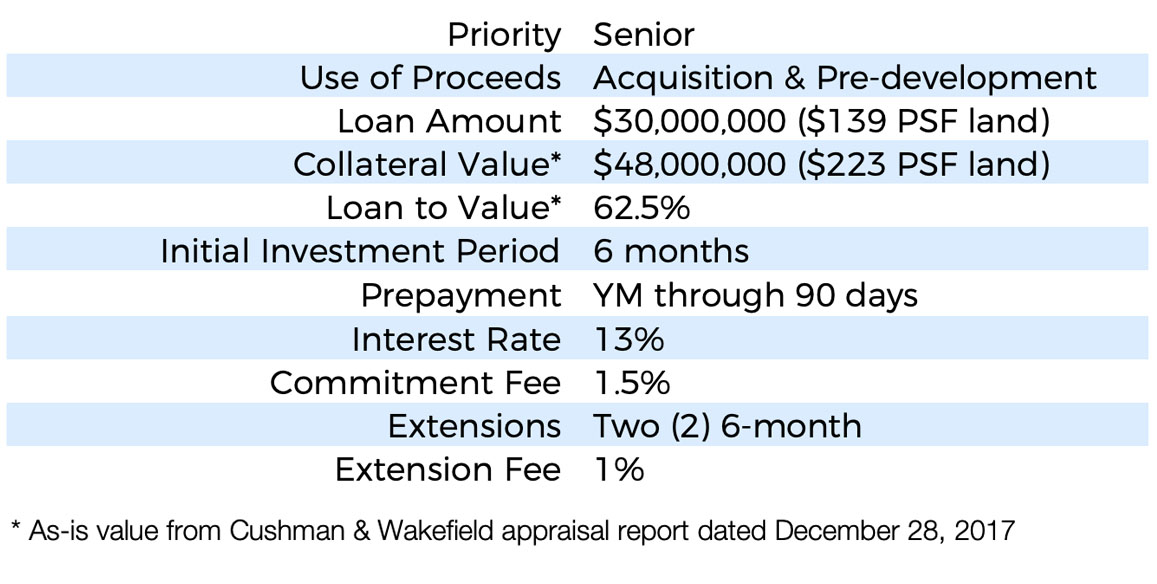

Deal Terms

Summary

Acquisition of a built and operational 1,086-unit (1.2M SF), four property multifamily portfolio spread across Mississippi and Alabama consisting of apartment complexes in Gulfport (426 units on 18 acres), Senatobia (80 units on 7 acres), Northtown (280 units on 7 acres), and Orange Beach (300 units on 51 acres). Sponsor plans to complete a $3.4M portfolio-wide renovation to upgrade and reposition properties to maintain occupancy, grow rents, and monetize the increased value through a sale or refinance at stabilization.

Investment Attributes

- Portfolio totals 59 acres over 4 properties

- Properties are located in strong rental markets and have actual occupancy rates ranging from 90.0% to 94.6%

- Investment basis of $75 PSF, or $70,286 per unit (when including senior debt) compared to as-stabilized in year 5 value of $108 PSF, or $100,883 per unit; the current cap rates on the properties range from 6.2% to 7.3%

Borrower & Development Team Experience

- Sponsor has over 30 years of experience in development of hotels across the U.S.

- On-site property management to be run by highly experienced firm managing similar properties, which will focus on upgrading existing processes to increase efficiency

Real Estate & Business Plan

Property Type: Multi-FamilyStrategy: Value AddPortfolio Units: 1,086Portfolio SF: 1.2MProperties: 4Renovation: $3.4MPrudential Senior Loan: Fannie Mae 4.25 – 4.76%

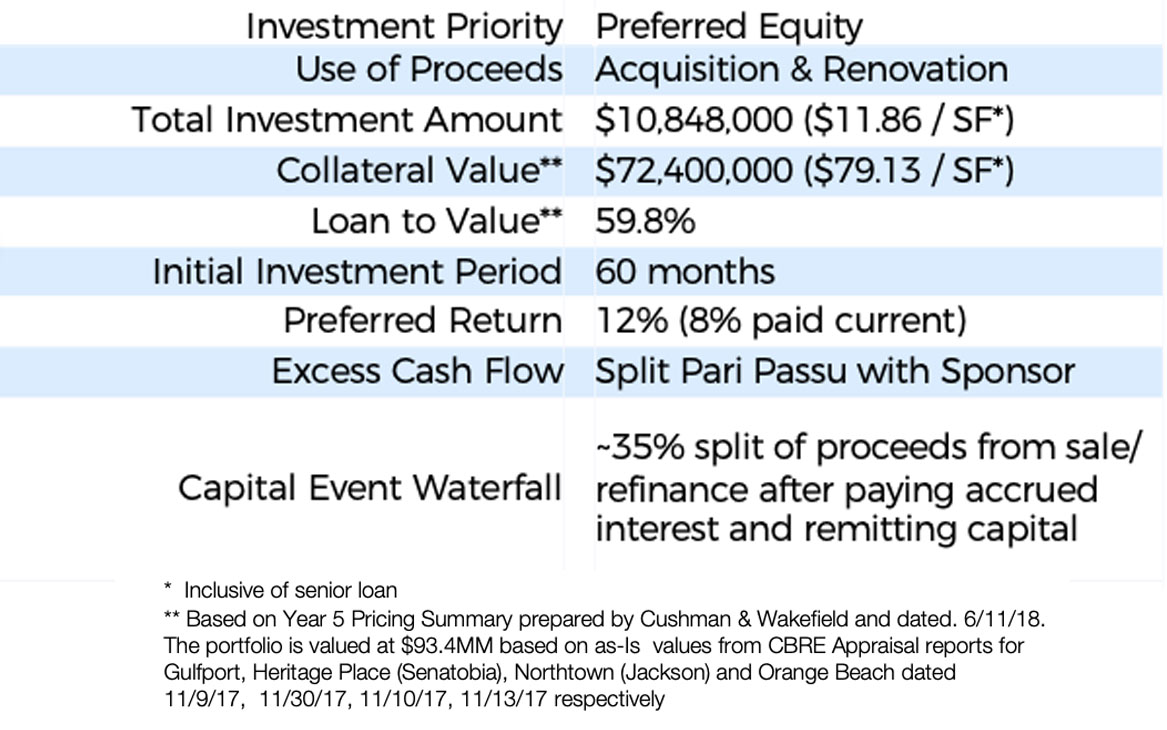

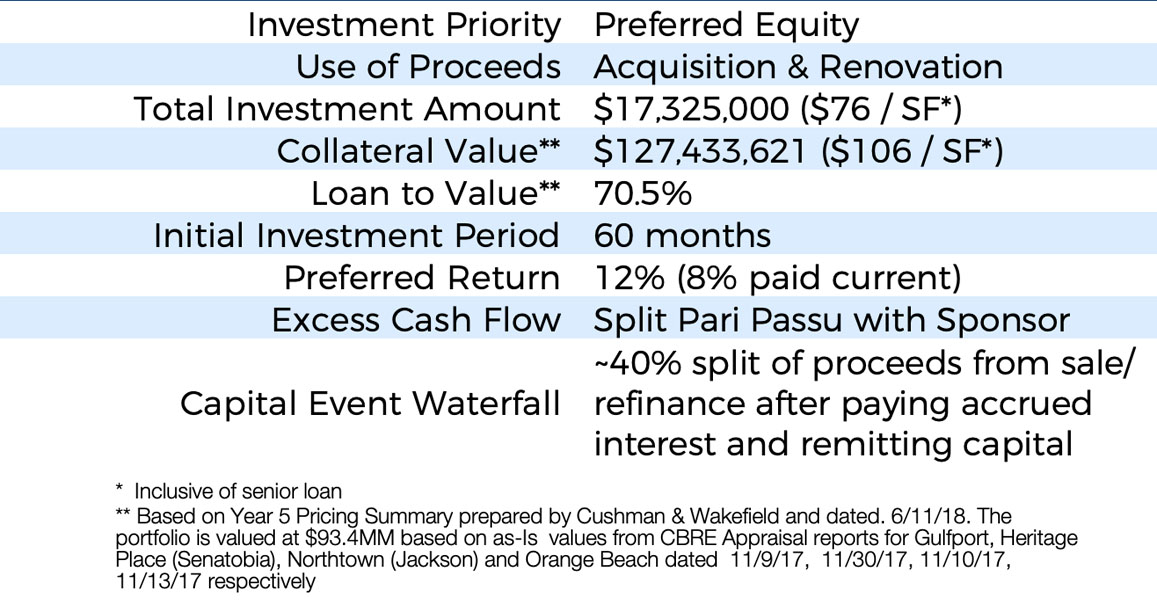

Deal Terms

Summary

Subject property is the former headquarters of a large publicly traded company. The 408-acre site is zoned for extensive industrial development with a flexible business plan that allows for the sale or development of excess land in developable parcels and the lease-up of the corporate headquarters and technology center buildings.

Investment Attributes

- Property sits in between Interstate 5 and State Route 18, which provide ample access to freeways, only a short distance from the ports of Puget Sound and the Seattle—Tacoma International Airport

- Strong market dynamics—industrial vacancy in the submarket currently sits at 2.7% and average rental rates have increased by 10% YoY ***

Borrower & Development Team Experience

- Sponsor owns and operates more than 150 major projects and developments in 28 states, with a privately held and managed portfolio in excess of 120M SF

Real Estate & Business Plan

Property Type: Land

Strategy: SF

Parcels: 2

Acres: 0.39M

Properties: 4

Acres: $3.4M

Micro Units: 231

Entitled: 100%

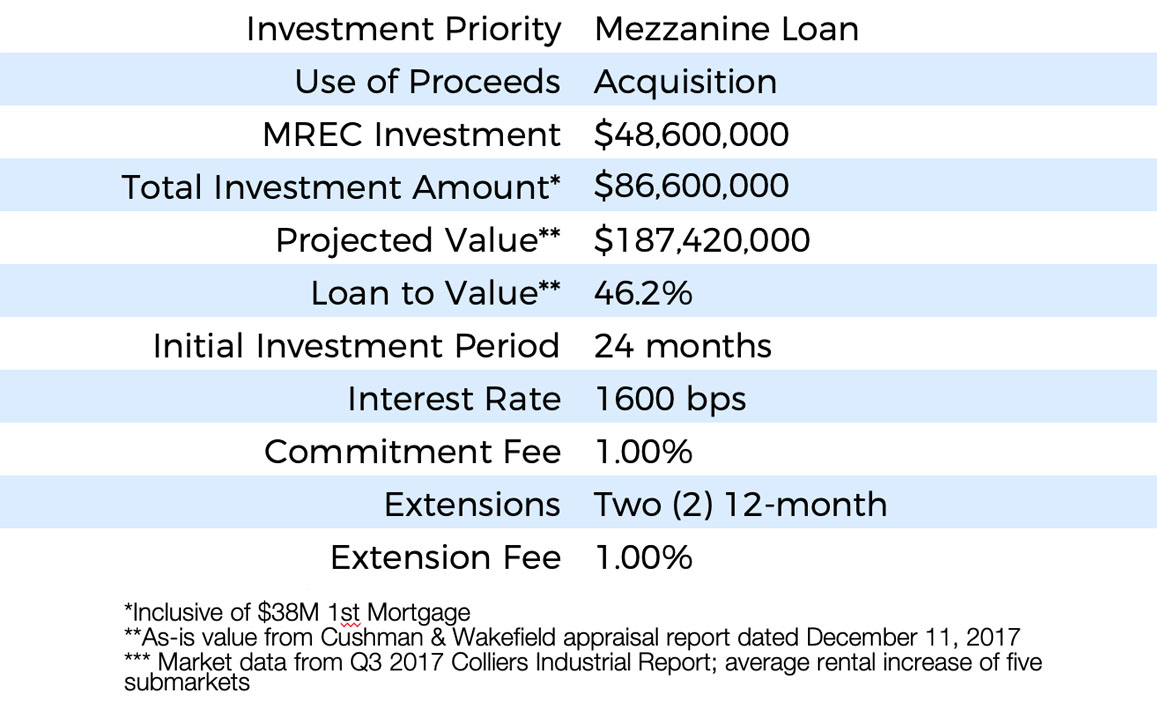

Deal Terms

Summary

Construction of fully-entitled 7-story mixed-use development with 19,000 SF of Retail, 22,000 SF of Office, and 68,000 SF comprised of 165 apartment units. University Gateway will be occupied by restaurants and retail on the first floor, office space on the second and third floors, and faculty/graduate student housing on the remaining four floors.

Investment Attributes

- The subject is located directly adjacent to the center of UNLV’s campus

- UNLV continues a large push to expand from a largely-commuter school to a full-scale, nationally renowned university, creating a large demand for on, or near, campus housing for students and faculty

Borrower & Development Team Experience

- Sponsor is a highly-experienced developer present in the Las Vegas market for nearly 25 years

- Guaranteed Maximum Price construction contract was agreed on in order to mitigate cost overrun risk.

Real Estate & Business Plan

Property Type: Mixed-Use

Strategy: Las Vegas

Retail (SF): 19,000

Office (SF): 22,000

Multifamily (SF): 68,000

Stories: 7

Pre-Leased: 50%+

Deal Terms

Summary

Predevelopment of an 18-acre parcel of land, fully entitled for a 387-unit multifamily development in Windsor, CA (Sonoma County) in a supply-constrained market, particularly after major fires.

Investment Attributes

- Sponsor worked two years and spent $7.5M to receive proper entitlements

- Apartments in the competitive market are currently 97% occupied with demand set to outstrip supply for the next four years

Borrower & Development Team Experience

- Sponsor possesses over thirty years of experience in the real estate industry, currently developing and maintaining real estate throughout California and the US.

Real Estate & Business Plan

Property Type: Land

Strategy: Sonoma County

Units: 387

Acres: 18

Equity Investment: $8.7M

Deal Terms

Summary

Acquisition and construction of a 3.5-acre site that is the first oceanfront lot inside the gate of the 10-mile long Kiawah Island. Site has began construction and started selling units. Completed product will consist of 21 fractional condominium residences in 3 buildings, an approximately 7,300 SF clubhouse and an approximately 3,600 SF beach club. Project will be managed by Timbers Resorts, an award-winning boutique luxury resort developer and operator.

Investment Attributes

- Site is a 45-minute drive from Downtown Charleston, SC and 50 minutes from the Charleston International Airport

- Located on one of the last remaining oceanfront parcels on Kiawah Island and first condo development on oceanfront since 1984

- Kiawah Island has demonstrated demand as a world-renowned destination for golfing after hosting the Ryder Cup and PGA Championship

Borrower & Development Team Experience

- Sponsor is a major global asset manager that manages over $8.6 billion in global real estate (and over $100B in total).

- Timbers Resorts, which has transacted over $900M in secondary vacation home sales across 16 properties (including the number one-rated resort in Europe and number two-rated resort in the world), is the developer and operator of the project

Real Estate & Business Plan

Property Type: Fractional

Area: Kiawah Island

SF: 55.1K

Ocean Frontage: 270ft

Clubhouse (SF): 7,300

Beach Club (SF): 3,600

Fractional Residences: 21

Completion Guaranty: $2.5B

Deal Terms

Summary

Construction of a 9.6-acre site development of 47 condominiums and townhomes across 3 buildings and the clubhouse, which is Phase 1 of the larger, 450-acre Hokuala Resort property. Construction is nearly complete and has been selling units. Project will be managed by Timbers Resorts, an award-winning boutique luxury resort developer and operator.

Investment Attributes

- Site sits on the South end of Kauai Island, a short distance from the town of Lihue with a private road to the international airport

- Located close to world-renowned beaches, golfing, hiking and other activities

- Completed project will include restaurants, a private club and lounge, pools, fitness center, spa & wellness center, business center and retail shops

Borrower & Development Team Experience

- Sponsor is a major global asset manager that manages over $8.6 billion in global real estate (and over $100B in total).

- Timbers Resorts, which has transacted over $900M in secondary vacation home sales across 16 properties (including the number one-rated resort in Europe and number two-rated resort in the world), is the developer and operator of the project

Real Estate & Business Plan

Property Type: Fractional

Area: Kauai

SF: 110.1K

Total Buildings: 4

Fractional Residences: 47

Completion Guaranty: $2.2B

Private Club & Lounge: 1

Golf Course: 1

Deal Terms

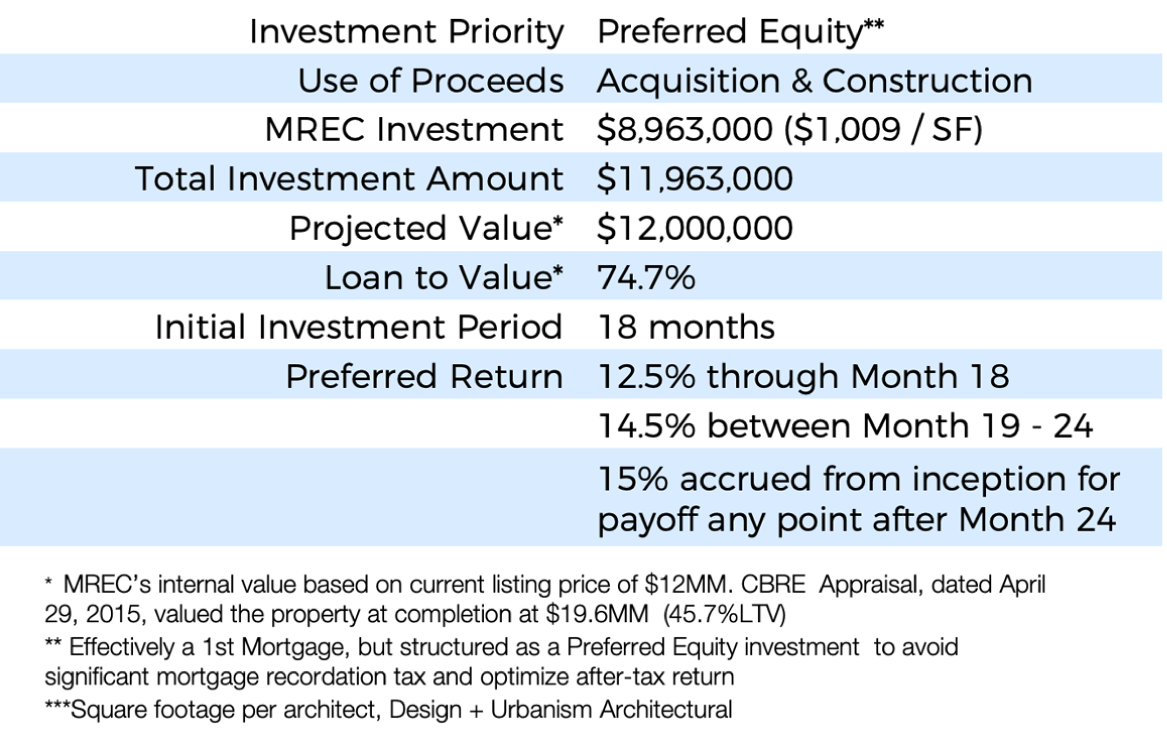

Summary

Conversion of a multifamily apartment building into a high-end single-family townhome in the heart of New York City’s Upper West Side. The subject sits on a tree-lined street which intersects with Central Park. Once complete, the final product will comprise of 7,339 SF of above-ground space and 1,545 SF of basement space, totaling 8,884 SF.

Investment Attributes

- Excellent location along beautiful tree-lined street just a short walk from Central Park

Borrower & Development Team Experience

- Sponsor is a real estate firm that specialized in the renovation and sale of high-end townhouses in the NYC metro area.

Real Estate & Business Plan

Property Type: Townhome

Area: NYC

Total SF: 8,884

Strategy: Renovation

Deal Terms

QUARTERLY LETTER

[pdf-embedder url=”http://temp.mosaicrei.com/wp-content/uploads/2019/03/Investor-Letter-Q4-2018_YTD_FINAL.pdf” title=”Quarterly Letter Q4 2018″].